Finding high-quality stocks with share prices under $10 can be a daunting task, as a low share price can signal significant issues with a company’s underlying business. But fear not, as there are some hidden gems in the $10 stock market bargain bin. Here are the top 5 stocks with share prices of $10 or less that demonstrate attractive business metrics, including profitability and long-term growth potential, as well as a Wall Street “buy” consensus and at least $50 million in market capitalization with forward earnings of less than 14.

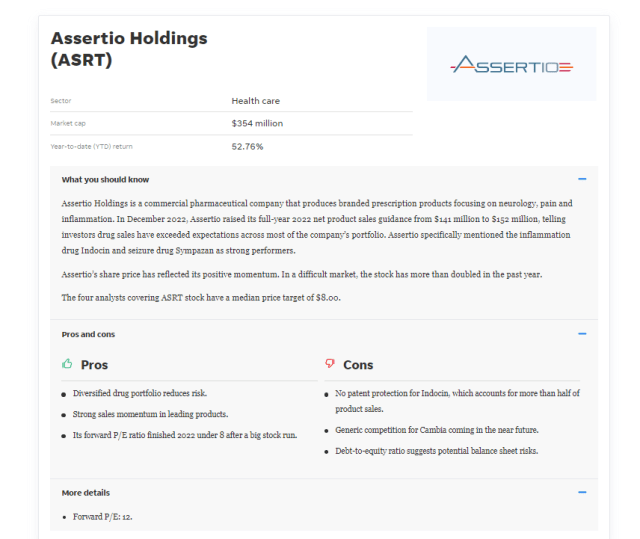

- Assertio Holdings (ASRT) – Healthcare, market cap $354 million, YTD return 52.76%

- CompoSecure (CMPO) – Industrials, market cap $573 million, YTD return 56.26%

- Garrett Motion (GTX) – Consumer Cyclical, market cap $496 million, YTD return -3%

- Heritage Global (HGBL) – Financial Services, market cap $106 million, YTD return 19%

- Vertex Energy (VTNR) – Energy, market cap $747 million, YTD return 66%

To identify these top stocks, we focused on analyzing whether it’s a good business by looking at key ratios such as profit margins, return on equity, and revenue growth, according to Alvin Carlos, a certified financial planner and managing partner at District Capital Management. We also used the following criteria:

- Altimeter overall grade of B or higher

- Market capitalization of at least $50 million

- Consensus analyst recommendation of “buy” or better

- Forward earnings multiple of less than 14

While buying stocks priced under $10 can be risky, diversifying your portfolio can help limit the risks of investing in cheap stocks. Remember to focus on a company’s business fundamentals rather than just its share price.

Receive the Only Headline Weekly Reporter Newsletter by SMS/Text covering the latest tech, biotech, growth, small and mid cap stocks analysis.

Gregory Timmons

Only Headline Contributor

On the date of publication, Gregory Timmons did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer/contributor. Greg Timmons is not a licensed financial advisor and this should not be construed as investment advice. Please consult your own financial professional.